Confusion rules. Has there been a time when, other than wars or economic reversals, everything was so up in the air? In just the last couple of weeks, we’ve had a meltdown over frozen Greenland, a fleet racing to the Middle East for possible military action against Iran, and the appointment of a Federal Reserve chairman philosophically at odds with the President, who appointed him. All with worldwide implications. What can we make of all this?

We’ve gone from giving the U.S. Greenland or else, to we’ll work things out—no big deal. Wait, wasn’t our need to possess Greenland a necessity for national defense? As I pointed out in the last post, we already had access to everything in Greenland that we would ever need. We antagonized our allies for no discernible end. Will Trump return to his demands again down the road?

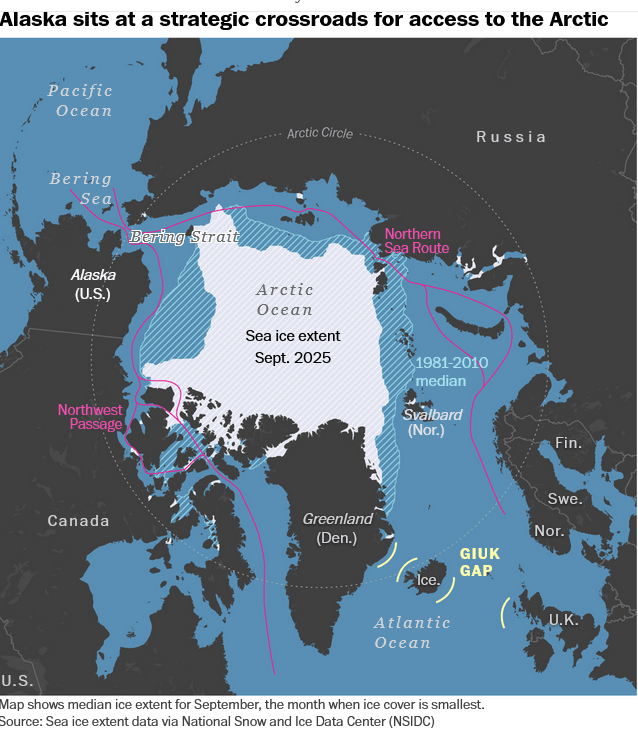

The administration is correct in acknowledging the Arctic’s rapidly increasing importance. Still, as others and I pointed out, China has more to fear from us regarding the new Arctic trade routes than we do from it. This map makes it obvious where the choke point for both routes lies, and it isn’t Greenland. It is already part of the U.S., our state of Alaska:

As you can see, both new shorter routes run through the Bering Strait, which Alaska dominates. A reasonably strong Alaska military position could close the strait to China’s trade, and China would have to pay hell to regain passage there, even if they could. After all, China would have to move its forces a great distance under to attack, only to find a well-positioned enemy. If we take the proper military steps in Alaska, we, not China, possess the leverage in the Arctic.

Given this strategic fact, Trump’s campaign to grab Greenland was about his legacy, rather than national defense. We’ll determine the cost of his vanity later.

Continue reading