Years of heavier-than-usual rains, followed by dry and hot weather, left vast fuel for fires. Winter brings the dangerous and unpredictable Santa Ana winds. Thank goodness California Governor Gavin Newsome had the foresight to call an emergency legislative session to fund preparations to handle the threatening situation.

Realizing what could be coming to vulnerable areas, successful governors get out in front and ensure everything is ready and working. Even though Florida suffered from severe hurricanes, Governor Ron DeSantis and his crew minimized problems and returned things to normal quickly.

Florida set the standard of preparedness for California to follow, and with overwhelming Democratic majorities, getting the needed funds and authorizations to be ready to meet the dangers presented no problem for Governor Newsome.

Oh, wait a minute. , the emergency legislative session wasn’t to prepare for a severe fire season; it was to appropriate funds to thwart Trump from expelling illegal aliens from California. The danger Newsome foresaw wasn’t from out-of-control wildfires; it was the federal Government initially deporting the illegal alien criminal element.

The result of this lack of preparation is likely to be the worst wildfire disaster in history. Fire hydrants without water are incompressible, as is a key reservoir without any water. Does this sound like preparation?

This absence of competence isn’t due to Californians not being taxed enough to measure up. They pay a lot more than Floridians. So why does Florida do so much better in crisis? The Sunshine State may spend more wisely.

It isn’t global warming. Both states are equally affected—after all, it’s one planet. No state has invested more and taken more action in combating Global warming than California. Of course, all of it has had zero effect. The truth is that nothing California or even the United States can do will change the direction of global temperatures. It could be a simple difference in competence.

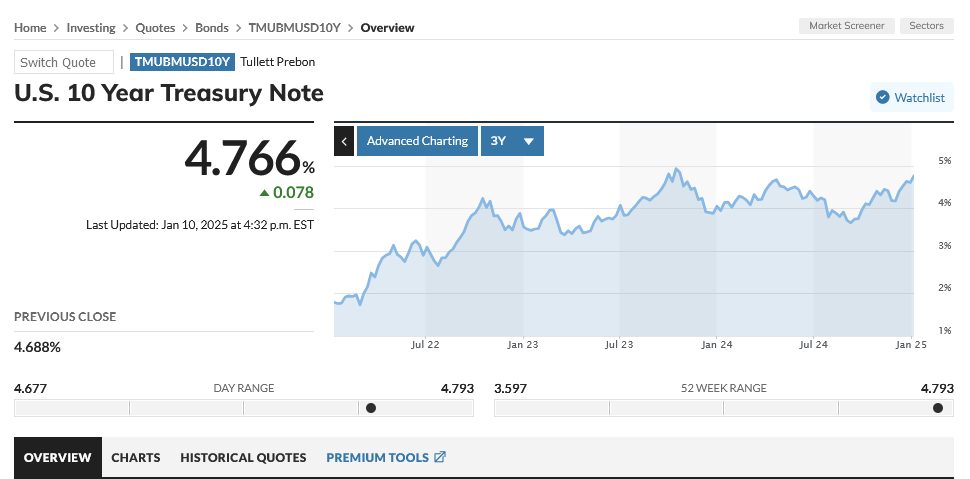

Yes, I’ve shown this chart before, but it bears watching:

While the Federal Reserve has been lowering rates, longer rates are approaching levels reached when inflation was 9%. What is it the market sees the Fed is ignoring? Could higher inflation be in our future? Could the brilliant minds at that institution be missing the signals again? Remember, a few years ago, they told us not to worry; the price rise was transitory.

If the Fed cuts interest rates, it’s stimulative. The same is true if the Government runs a large deficit. Goosing demand not offset by increased supply is the classic “too many dollars chasing too few goods” definition of inflation. As I’ve pointed out, mandatory spending on Social Security, Medicare, and other entitlements will force higher government expenditure not so far down the road. Is the present stimulus adding to the dangers?

Trump’s tariff threats, tax cuts, and regulatory reforms present a mixed bag. The latter two may lower prices, while tariffs will raise prices. Can anything bolster the supply enough to meet the visible increase in demand?

So far, the market is increasingly saying it is not likely. Trump’s challenge is to change this perception.

It’s not how much you spend but how you spend it. Money spent on unproductive endeavors is consumption. Productive use leads to expanded supply at better prices, which allows for more for the same amount of money.

Nothing illustrates the misallocation of resources or green spending better than our media, which is filled with stories of billions allocated for huge battery factories and charging stations and more funds for Electric Vehicle (EV) subsidies. All told, President Biden’s green spending approaches a trillion dollars.

Borrowing all this money is necessary because we are nowhere near a balanced budget. To the extent the Fed keeps short-term interest rates lower than those the market might impose, it supports this spending. The fact that most government borrowing is short-term points to what is happening. Most people realize this financing is highly dangerous. Locking in long-term rates you know you can handle protects you from sudden change. Even if short rates quickly rise, it does not affect your 30-year mortgage.

Yet, the treasury geniuses, aided by the Fed, have set us up for a considerable budget explosion. Remember, Murphy’s Law says if something can go wrong, it will go sometime.

This dangerous spending by the U.S. might be worth it if it prevents climate change to the extent that it saves much more in the future. Unfortunately, it won’t have any effect—none! So long as the rest of the world keeps expanding its use of fossil fuels, carbon in the atmosphere will grow no matter what we do.

Slowing sales of battery-powered EVs might indicate they aren’t the future, but hydrogen is gaining. It may be more practical for a wider variety of vehicles, ships, and planes, and cheaper supplies may be in the offing. Yet, the federal Government and California invest heavily in battery EVs

While we make bad decisions, The Wall Street Journal tells us who made the right bet. An Indonesian coal magnate can’t expand fast enough to meet Asian demand. So long as emerging nations need reasonable, reliable energy to improve lives, they will get it where they can.

Wind and solar power don’t meet their needs. This conclusion isn’t surprising. Our tech companies are looking to nuclear power to provide reliable power for their future needs.

The folly of all this Green spending glows brightly in California’s present disaster. The state appropriates $1.4 billion for EV chargers while cutting 100 million from fire protection.

At the national level, while we spend record amounts chasing a Green Agenda, the defense budget declines in real terms. This outcome is in the face of an increasingly dangerous world.

What explains this widespread incompetence undermining faith in our major institutions? In private industry, misallocating resources leads to profit loss and, if continued, demise.

Our founding fathers ran businesses while serving in public service. Experience in the real world should be a requirement for public office. Not having to produce a return on investment allows for ivory-tower thinking, leading to incompetent actions. We should make reversing this trend a national priority.