Democratic Politicians and allied media, echoing some economists like Paul Krugman, paint a rosy picture of our economy. They question why we’re less content while supposedly outperforming other nations. Catherine Rampall, the Washinton Post economics columnist, tells us, “Nearly everything Americans believe about the economy is wrong, according to a recent Harris-Guardian poll. And that’s pretty much everyone’s fault.” This narrative implies that our dissatisfaction is unfounded. But is this the whole truth? Are there no deeper economic issues that we need to address?

After a lifetime of talking to people about their finances, I have gained a profound understanding of how people assess their financial well-being. In most cases, having a growing amount left over at the end of each month tells them whether they’re just subsisting or can think of the things that make life worth living—a vacation, maybe with your family, or a better house. Whatever your dream, it always requires money. Unless you have discretionary income, you can’t fulfill it, whatever it is.

When every basic bill, from rent to utilities and insurance, elicits a gasp, even a raise can’t alleviate the feeling of being trapped. The necessities of life, like food, transportation, and clothing, become burdens, and dreams start to fade. This situation is actual for many hardworking Americans struggling to make ends meet.

While economists discuss prices and wages, the reality is far more complex. Your pay may rise, but your grandpa’s and grandma’s income may be more fixed. Where they could pay their way in the past, now they need help to meet their rising bills. You thought you had the kid’s education covered, only to find a widening gap. These stark realities are not just isolated incidents but the daily norm for more people. No wonder those telling us how well we’re doing only get blank stares.

Inflation is the source of most of our angst, but if you feel future inflation isn’t dangerous, steps to rein it aren’t topping your to-do list. Everybody seems to be waiting for the Federal Reserve to lower interest rates, which presupposes inflation is under control. How likely is this situation to be accurate in the future?

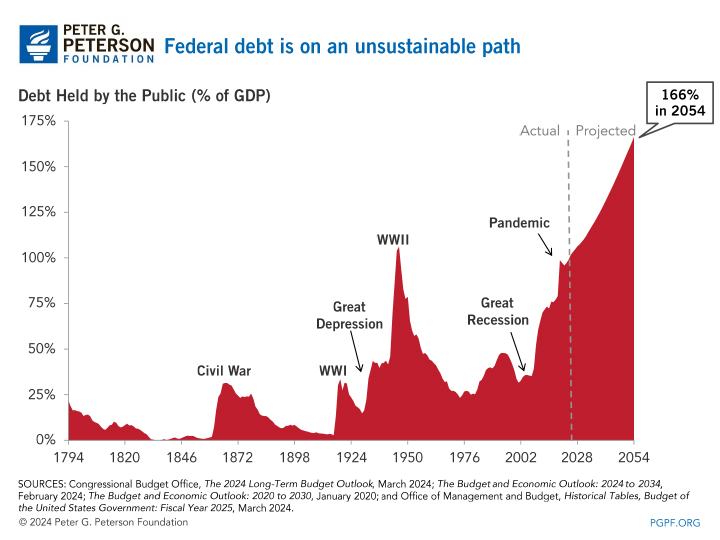

The classic definition of inflation is “too much money chasing too few goods.” We have to borrow when revenues don’t cover our government’s expenditures. If we dump ever-growing amounts of debt on the market and the Federal Reserve fails to intervene, ever-rising interest rates will be required to find buyers. Already, we pay more on our debt than on defense. In the future, the payments will crush the entire budget. This crisis is not a distant possibility but a potential economic catastrophe that we must address:

Of course, the Federal Reserve can buy the debt with money created out of thin air. This course of action is how we get runaway inflation: one way or another, overspending results in the unkindest tax inflation.

Raising taxes doesn’t mean you’ll cover expenses. Even with tax brackets rising to 90%, revenues peaked at 20% of GDP during the high tax period from 1940 to the 1980s. Yet, our spending is consistently above 20%-currently 23% and rising. High taxes cause people and businesses to change their behavior or location. This result is what the Laffer Curve is all about:

If we can’t tackle expenditures that expand demand, we should at least do our best to enlarge supply. In my “Stopping Inflation” series, ” I offer several ways to accomplish this goal. Reducing regulations, encouraging productive business investment, and implementing a workable immigration policy could directly reduce costs, leading to lower prices. However, doing anything productive in this country is needlessly tricky or impossible.

One of the worst things you can do is stimulate malinvestment by choosing winners or losers. For instance, the trillions committed to the “Green New Deal” are centered on questionable technologies. Windmills, solar panels, and electric vehicles (EVs) could quickly become stranded assets. You’ve added trillions to our debt, only to find you have nothing to show for it.

The market may be pointing in other directions. AI and other data centers require vast amounts of dependable energy. Windmills and solar are intermittent and, therefore, need backup. For that reason, Microsoft and others are looking for new types of nuclear power.

Batteries don’t work for larger working vehicles, ships, and planes. Hydrogen does. Toyota, the world’s best vehicle company, is building hydrogen trucks. Hydrogen requires a lot of expensive energy, but it is the most common element with zero pollution, and prices will decrease. A possible synergy is using the high-tech industry’s excess nuclear capacity to produce hydrogen. If trucks run on hydrogen, it will be available coast to coast, making it convenient for all.

Will we be powered by nuclear and hydrogen or something else? Let the market decide.

It’s always best to allow the market to allocate resources rather than some elites. China suffers from government-subsidized housing and heavy industry, which has resulted in vast amounts of stranded capital. It may soon add windmills, solar panels, and EVS, where they now lead the world. Add an aging, declining, and unbalanced population. All of these problems are due to some elites thinking they knew best.

Republicans and Democrats who promote a government industrial policy (Government-directed investment) rather than taking action to bring inflation down need a remedial course in capitalism, starting with Adam Smith. Capitalism, with its free markets, has outperformed everything else. Why would we emulate the Soviet Union, Cuba, Venezuela, and now China?

Rather than telling us how good we have it, those running for office shoud explain how they plan to reduce inflation, making us miserable—a course of action to mitigate future expenditures and increase supply. Do you hear anything that will accomplish this from those seeking to lead us? I haven’t.