Democratic Politicians and allied media, echoing some economists like Paul Krugman, paint a rosy picture of our economy. They question why we’re less content while supposedly outperforming other nations. Catherine Rampall, the Washinton Post economics columnist, tells us, “Nearly everything Americans believe about the economy is wrong, according to a recent Harris-Guardian poll. And that’s pretty much everyone’s fault.” This narrative implies that our dissatisfaction is unfounded. But is this the whole truth? Are there no deeper economic issues that we need to address?

After a lifetime of talking to people about their finances, I have gained a profound understanding of how people assess their financial well-being. In most cases, having a growing amount left over at the end of each month tells them whether they’re just subsisting or can think of the things that make life worth living—a vacation, maybe with your family, or a better house. Whatever your dream, it always requires money. Unless you have discretionary income, you can’t fulfill it, whatever it is.

When every basic bill, from rent to utilities and insurance, elicits a gasp, even a raise can’t alleviate the feeling of being trapped. The necessities of life, like food, transportation, and clothing, become burdens, and dreams start to fade. This situation is actual for many hardworking Americans struggling to make ends meet.

While economists discuss prices and wages, the reality is far more complex. Your pay may rise, but your grandpa’s and grandma’s income may be more fixed. Where they could pay their way in the past, now they need help to meet their rising bills. You thought you had the kid’s education covered, only to find a widening gap. These stark realities are not just isolated incidents but the daily norm for more people. No wonder those telling us how well we’re doing only get blank stares.

Inflation is the source of most of our angst, but if you feel future inflation isn’t dangerous, steps to rein it aren’t topping your to-do list. Everybody seems to be waiting for the Federal Reserve to lower interest rates, which presupposes inflation is under control. How likely is this situation to be accurate in the future?

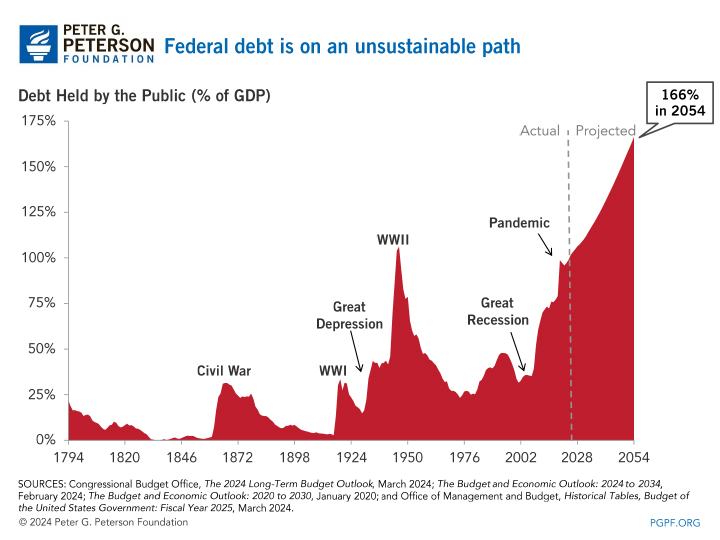

The classic definition of inflation is “too much money chasing too few goods.” We have to borrow when revenues don’t cover our government’s expenditures. If we dump ever-growing amounts of debt on the market and the Federal Reserve fails to intervene, ever-rising interest rates will be required to find buyers. Already, we pay more on our debt than on defense. In the future, the payments will crush the entire budget. This crisis is not a distant possibility but a potential economic catastrophe that we must address:

Of course, the Federal Reserve can buy the debt with money created out of thin air. This course of action is how we get runaway inflation: one way or another, overspending results in the unkindest tax inflation.

Continue reading