Inflation continues, and our politicians are busy blaming each other rather than offering common sense solutions. They and the media keep pointing to specific products and sectors in the Consumer Price Index (CPI), causing the price to rise. Akin to the blind men describing an elephant, it’s energy, no rent, no wages, and on and on. We must realize that certain items aren’t going up simultaneously, but an increase in one leads to another; once inflation takes hold, it continues to rachet up until supply increases force prices down or demand is curtailed to the point that lack of sales stops prices from rising.

The last significant inflationary period was in the 1970s and early ’80s. It was brought under control by a combination of the Federal Reserve, raising the cost of borrowing so high it crushed demand, resulting in a severe recession. At the same time, we lowered taxes and regulations. Government pushback, such as Reagan’s firing of the Air comptrollers and continued business movement to right-to-work states, curbed wage demands and improved productivity.

Lowering expenses and making more investment capital available increased businesses’ incentive to expand production. The increase in supply met or exceeded demand, mitigating price pressures. We often forget to look at the profit & Loss effect spurring investment:

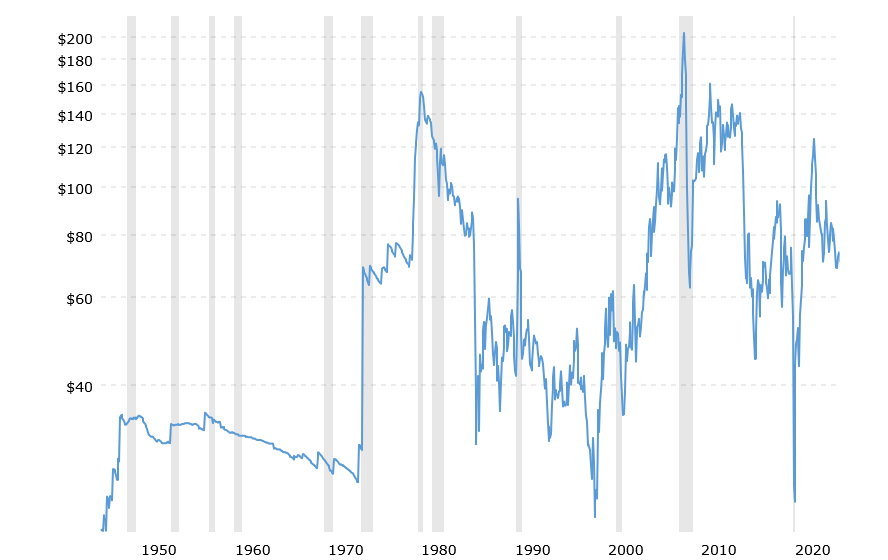

The impact on energy prices illustrates how well this worked.

The Great Inflation of the 1970s got its kickstart with the dramatic increase in the crude oil price following the Arab oil embargo. Because oil prices affect so much of the economy, price pressure spreads. Prices followed as transport, chemicals, fertilizer, and heating costs increased.

Rather than suppress the resulting inflation through high interest rates, the Fed created more money to accommodate it.

Each increase causes other prices to rise, pushing inflation ever higher. Government attempts to cap gas prices only made for long lines. When the Reagan administration finally implemented policies encouraging oil companies worldwide to find and produce more oil, the price fell from a crude barrel price in the 70-dollar range to $10 in less than two decades.

We curbed inflation by encouraging supply expansion while the Federal Reserve resisted printing money. The economy boomed. The lessons are clear: Encourage supply expansion and don’t put the Fed in a position of having to create credit or raise interest rates.

As Trump takes control, it is wise to consider what he inherited. The Biden administration did nothing to increase supply—just the opposite. Oil, again, is indicative of that administration’s mindset. It removed millions of acres from exploration and development while abandoning needed pipelines.

At the same time, the administration poured billions into the attempt to produce strategic goods and elements of green energy in the U.S., including computer chips and electric vehicle (EV) batteries. This program will only deliver products at higher than world prices. As I’ve pointed out, this uneconomic plan is inflationary.

So far, the Federal Reserve (Fed) has accommodated inflation by reducing short-term interest rates by a whole point. This move is in the face of the 10-year Treasury bond rate staying near its highs.

The rate of inflation declined from nine to three percent. In the 1970s, the 1973 inflation rate fell from 8.7% to 4.9% in 1976, and the Fed lowered interest rates. Today, prices are still increasing, but the Fed lowered rates like inflation was over. The inflation rate in 1979 rose to 13,3%. The Fed had to raise the federal funds rate to a whopping 18%, causing a severe recession. Presently, the Fed has paused reducing rates.

With prices still rising, Trump is in the dicey position of controlling inflation before it gets out of hand, forcing the Fed to jam on the brakes and throwing the economy into a recession. The Trump administration has learned some of the lessons of the 1970s inflation. Retaining the tax relief of his first term while reducing regulations can increase businesses’ investment in lower-cost supply.

Reversing the Biden administration’s anti-oil actions is one example. Reducing the overall size of the federal government can cut the deficit while improving efficiency. No one claims there isn’t waste and fraud for Eon Musk’s minions to find. Defunding Biden’s uneconomic Green energy boondoggles save a lot. All these actions are steps in the right direction.

Unfortunately, other actions and non-actions might derail Trump’s positive moves from ending our inflation. Threatening high tariffs to get others to lower theirs is one thing; putting them in effect is a tax. Protecting otherwise weak businesses wastes resources. A tariff wall can’t help being inflationary. Already, he is putting a 25% tariff on steel and aluminum. In Trump’s first term, his steel tariffs raised prices and cost jobs, so why repeat and extend errors?

Trump’s proposals to eliminate taxes on tips and social security (SS) payments will raise rather than lower the deficit while reducing the time before the SS trust fund runs dry. I’ve discussed this before. After real-term reductions during the Biden administration, the Defense Department needs increased funding beyond Elon Musk’s DODGE savings. The world is more dangerous at a time when we are relatively weaker. Trump is right to spend what is needed, but it will raise outlays.

By excluding mandatory spending such as SS and Medicare, he has shielded so much of the budget from cuts that it’s hard to see how we’ll positively affect inflation, even if Trump gets everything else from Congress and DOGE. It’s no sure thing he’ll get his program in place, given his narrow majorities in both houses of Congress and the Democrats united in fighting him in Congress and the courts every step of the way.

Add the fact Trump is a lame duck likely to lose one or both houses of Congress in two years, and every passing day lowers his ability to get his way. This situation illuminates why he is moving as fast as he can.

If Trump could overcome his self-imposed impediments, tariffs, tax relief for special groups, and walling off mandatory spending, he could avoid a very foreseeable future crisis. The rest of his program favors the supply increase needed to blunt rising prices. The Democrats haven’t proposed or done anything about inflation other than attacking grocers for price gouging. Do they even care?

Unless something changes, consider inflation is alive and well.