Inflation continues, and our politicians are busy blaming each other rather than offering common sense solutions. They and the media keep pointing to specific products and sectors in the Consumer Price Index (CPI), causing the price to rise. Akin to the blind men describing an elephant, it’s energy, no rent, no wages, and on and on. We must realize that certain items aren’t going up simultaneously, but an increase in one leads to another; once inflation takes hold, it continues to rachet up until supply increases force prices down or demand is curtailed to the point that lack of sales stops prices from rising.

The last significant inflationary period was in the 1970s and early ’80s. It was brought under control by a combination of the Federal Reserve, raising the cost of borrowing so high it crushed demand, resulting in a severe recession. At the same time, we lowered taxes and regulations. Government pushback, such as Reagan’s firing of the Air comptrollers and continued business movement to right-to-work states, curbed wage demands and improved productivity.

Lowering expenses and making more investment capital available increased businesses’ incentive to expand production. The increase in supply met or exceeded demand, mitigating price pressures. We often forget to look at the profit & Loss effect spurring investment:

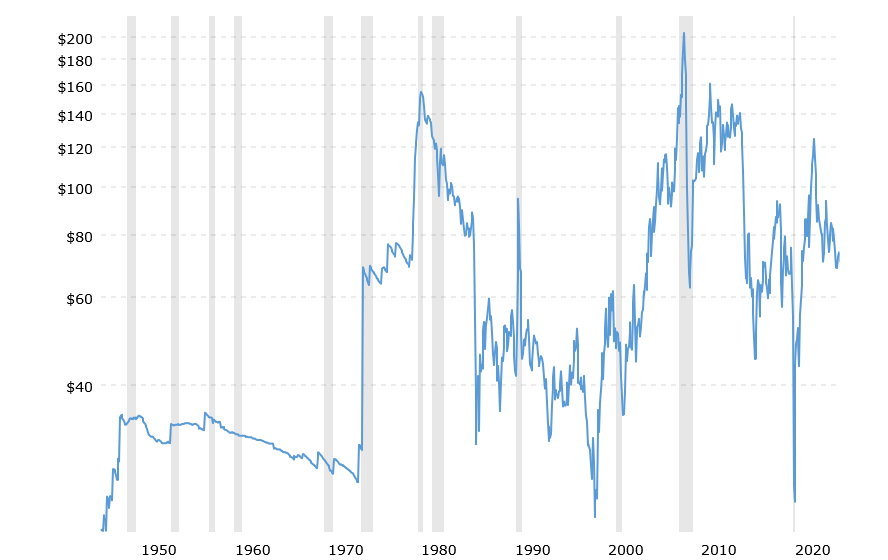

The impact on energy prices illustrates how well this worked.

The Great Inflation of the 1970s got its kickstart with the dramatic increase in the crude oil price following the Arab oil embargo. Because oil prices affect so much of the economy, price pressure spreads. Prices followed as transport, chemicals, fertilizer, and heating costs increased.

Rather than suppress the resulting inflation through high interest rates, the Fed created more money to accommodate it.

Continue reading